第一道题:

Which of the following stalements is the least likely to be correct regarding Indetest rale risk munagement by EME banks ?

A In comparison with banks in many advanced economies (AEs), banks in emerging market economies (EMEs) make less use of derivatives tomanage IRR.

B EMEs reduces the impact of interest rate changes on its interest income by limiting the repricing gap between assets and liabilities.

C EME banks‘ securities holdings are increasing which changing the nature of their exposure to interest rate risk.

D The longer the term of a financial instrument is, the greater the direct impact of interest rate changes on its (net present value) will be

答案:D

第二道题

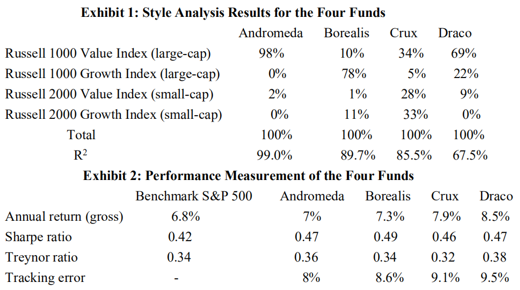

Joan Berkeley is an investment analyst for a U.S.-based pension fund that considers adding a large capitalization equity mutual fund to its asset mix. To assess these funds better, Joan conducts detailed quantitative analysis on four mutual funds that claim to be large-capitalization funds. The quantitative results are shown in Exhibits 1 and 2.

Based on the above results, Joan made several comments. Which of the following statements is least likely to be correct?

A Andromeda is a passively managed fund.

B The pension fund should invest in the Borealis fund because it has the highest Sharpe ratio.

C Crux's investment style has drifted to small-capitalization

D Draco has the highest Information Ratio.

Answer: B