想要在CFA考试中取得高分,刷题是必不可少的,那么小编下面也给大家分享一道在CFA二级权益投资中的题目,跟着小编一起来看看吧!

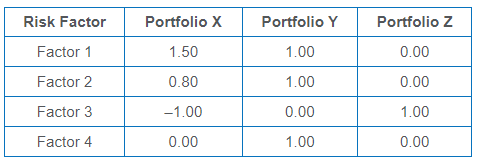

A portfolio manager gathers the following information about three well-diversified portfolios and their sensitivities to four factors using a macroeconomic factor model:

The portfolio best suited to hedge an existing short exposure to Factor 3 is:

A Portfolio X.

B Portfolio Y.

C Portfolio Z.

解析:

A.Incorrect because Portfolio X is not a factor portfolio as it is sensitive to more than one factor. Therefore, it is not the portfolio best suited to hedge an existing exposure to Factor 3.

B.Incorrect because Portfolio Y has a sensitivity of 0 to Factor 3 and so will not be useful in managing an existing exposure to this factor.

C.Correct because Portfolio Z is a factor portfolio with exposure to only one risk factor and exactly represents the risk of that factor. As a pure bet on a source of risk, factor portfolios are of interest to a portfolio manager who wants to hedge that risk (offset it) or speculate on it. So, Portfolio Z is best suited to hedge an existing short exposure to Factor 3.