CFA二级考试备考的如何?考生备考CFA二级考试中知识点学习的如何?在二级备考中固收期限结构与利率的动态变动知识点学习的如何?一起做一下考试题!

CFA备考怎么能少了CFA备考资料呢?小编为各位考生准备了CFA备考资料,有需要可以点击下方链接获取!

Which of the following statements about traditional term structure theories is incorrect?

A.Unbiased expectation theory argues that a forward interest rate corresponding to a certain future period is equal to the expected future zero interest rate for that period.

B.Under segmented market theory,a major investor such as a large pension fund or an insurance company invests in bonds of a certain maturity and does not readily switch from one maturity to another.

C.The basic assumption underlying the preferred habitat theory is that investors prefer to preserve their liquidity and invest funds for short periods of time.

答案:C

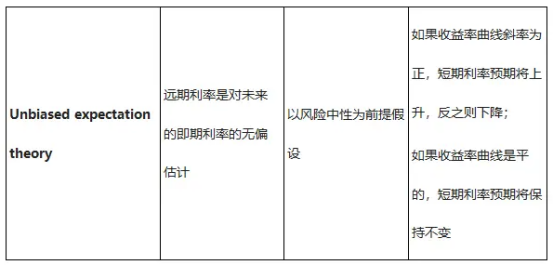

考点:无偏预期理论是传统利率期限理论的一种,考生需熟悉其基本假设及特征。

解析:选项C的描述并不是期限优先理论(preferred habitat theory)的基本假设,期限优先理论的基本假设是只有当预期的额外收益(expected additional returns)足够高时,投资者才会偏离既定的投资期限偏好,因此,选项C描述错误,符合题意,为正确选项

对于选项A,无偏预期理论(unbiased expectation theory)也被称为完全预期理论(pure expectation theory),其认为远期利率是对未来即期利率的无偏估计,因此,描述正确,不符合题意,为错误选项

备考CFA考试二级考试这边有CFA二级考试题库可以辅助练习,需要的话可以在线咨询,这边还有相关的资料和网课,需要可以添加老师微信:rongyuejiaoyu