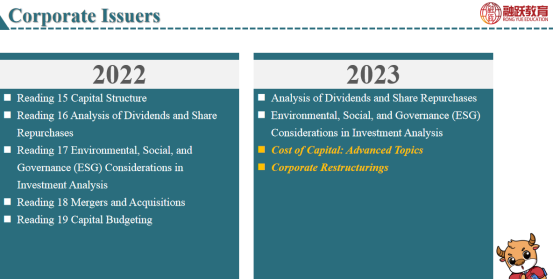

备考2022年CFA二级考试,在学习Corporate Issuers这个科目时,要知道这个科目中2023年是怎样做调整的,今天跟着融跃CFA一起看看吧!

2023年变化主要为章节不再以Reading排序,原reading 15 、18、19删除,新增Cost of Capital: Advanced Topics、Corporate Restructurings模块,新增的章节有哪些变化?跟着融跃一起看看二级科目考纲变化!

一、Cost of Capital: Advanced Topics

explain top-down and bottom-up factors that impact the cost of capital

Compare methods used to estimate the cost of debt.

explain historical and forward-looking approaches to estimating an equity risk premium

compare methods used to estimate the required return on equity

estimate the cost of debt or required return on equity for a public company and a private company

evaluate a company’s capital structure and cost of capital relative to peers

二、Corporate Restructurings

explain types of corporate restructurings and issuers’ motivations for pursuing them

explain the initial evaluation of a corporate restructuring

demonstrate valuation methods for, and interpret valuations of, companies involved in corporate restructurings

demonstrate how corporate restructurings affect an issuer’s EPS, net debt to EBITDA ratio, and weighted average cost of capital

evaluate corporate investment actions, including equity investments, joint ventures, and acquisitions

evaluate corporate divestment actions, including sales and spin offs

evaluate cost and balance sheet restructuri