2021年CFA道德由原来的第1门课程调整为zui后一门科目(Study Session 1&2变为Study Session 15&16 ),新的考纲 Study Session 1为行为金融学,这是CFA三级考纲zui大的不同,那2022年CFA三级考纲的变化还有哪些呢?和小编一起看看!

整体下来看,2022年CFA三级变动不大相比2021年考纲来说,那有哪些变化呢?和小编一起走进2022年CFA三级考纲中去!

原考纲 Reading 7 The Behavioral Finance Perspective删除;原考纲所有Reading编号改变,但是实质内容基本未发生改变;原考纲中部分Reading在新考纲中合并,本质未发生变化;新考纲中添加部分小知识点,整体变动不大,具体各个科目是怎样的呢?和小编一起看看各个科目的变化!

CFA备考怎么能少了CFA备考资料呢?小编为各位考生准备了CFA备考资料,有需要可以点击下方链接获取!

戳:各科必背定义+历年真题中文解析+学习备考资料(PDF版)

1、Behavior Finance

原内容:Reading 7 The Behavioral Finance Perspective从新考纲删除

原内容:Reading 8中 Evaluate how behavioral biases affect investment policy and asset allocation decisions and recommend approaches to mitigate their effects. 删除

原内容Reading 9对应新考纲reading 2,考察内容未发生改变

对传统金融学的考察能力要求降低,对行为偏差对于投资政策和资产配置的考察移动到后面章节考察。

新考纲 Reading 1: the behavioral biases of individuals 对于认知偏差和情感偏差的要求从原考纲distinguish改成compare and contrast

即更改为:compare and contrast cognitive errors and emotional biases

对比原考纲distinguish改成compare and contrast,要求掌握程度提升

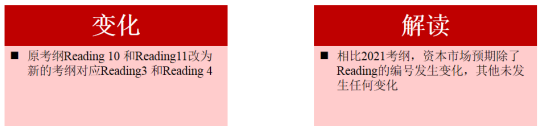

2、Capital Market Expectations

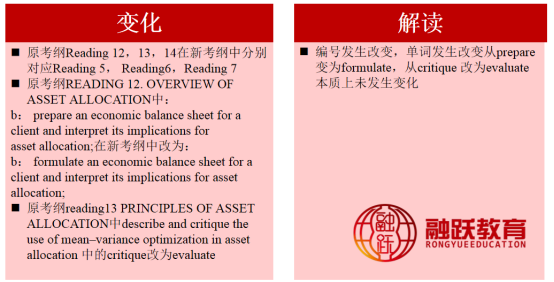

3、ASSET ALLOCATION

4、Derivatives and Currency Management

Reading 15,16,17更改为新考纲下reading 8,9,10,仅仅reading的编号发生改变,考纲未发生任何变动。

5、Fixed-Income Portfolio Management (1)

原考纲reading 18,19对应新考纲reading11,12,

原考纲READING 18. OVERVIEW OF FIXED-INCOME PORTFOLIO MANAGEMENT

a: discuss roles of fixed-income securities in portfolios;

b: describe how fixed-income mandates may be classified and compare features of the mandates;

改为新考纲中的:

a. discuss roles of fixed-income securities in portfolios and how fixed-income mandates may be classified;

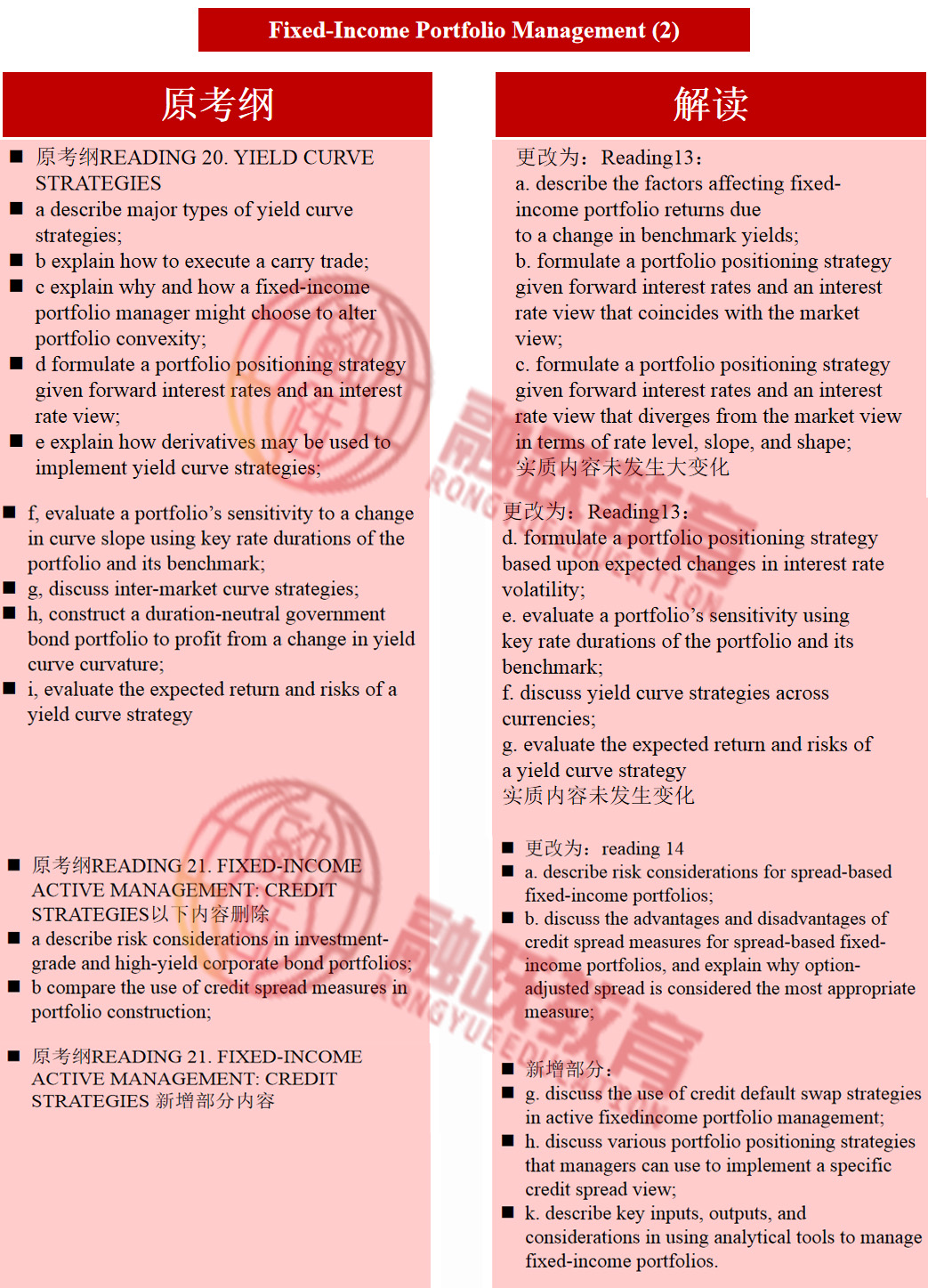

Fixed-Income Portfolio Management (2)

6、Alternative

原考纲READING 26,27对应新考纲Reading 19,20,仅编号发生改变,内容无任何改变。

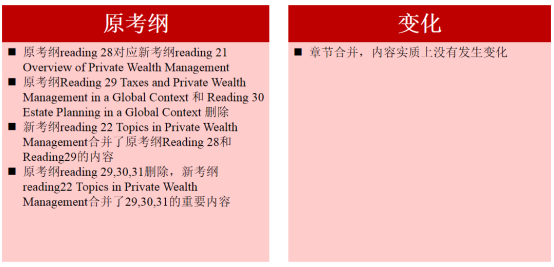

Private Wealth Management (1)

Private Wealth Management (2)

原考纲READING 32. RISK MANAGEMENT FOR INDIVIDUALS更改为新考纲 READING 23. RISK MANAGEMENT FOR INDIVIDUALS

原考纲READING 33. PORTFOLIO MANAGEMENT FOR INSTITUTIONAL

INVESTORS改为READING 24. PORTFOLIO MANAGEMENT FOR INSTITUTIONALINVESTORS

Trading, Performance Evaluation, and Manager Selection

原考纲READING 34. TRADE STRATEGY AND EXECUTION

d. select and justify a trading strategy (given relevant facts);更改为READING 25. TRADE STRATEGY AND EXECUTION

d. recommend and justify a trading strategy (given relevant facts);

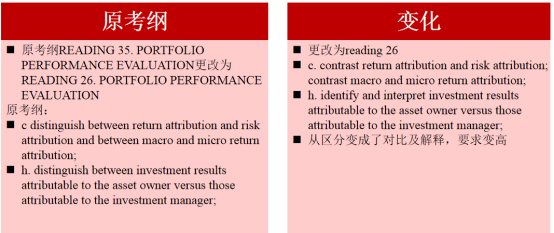

更改为reading 26

c. contrast return attribution and risk attribution; contrast macro and micro return attribution;

h. identify and interpret investment results attributable to the asset owner versus those attributable to the investment manager;

从区分变成了对比及解释,要求变高

原考纲READING 36. INVESTMENT MANAGER SELECTION改为新考纲READING 27. INVESTMENT MANAGER SELECTION

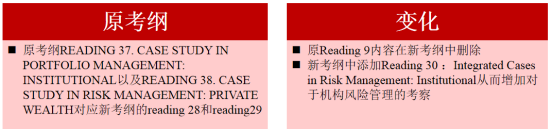

Cases in Portfolio Managementand Risk Management

7、Ethical and Professional Standards

原考纲READING 1. CODE OF ETHICS AND STANDARDS OF PROFESSIONAL CONDUCT

READING 2. GUIDANCE FOR STANDARDS I–VII

READING 3. APPLICATION OF THE CODE AND STANDARDS: LEVEL III分别对应新考纲中的READING 31,32,33

原考纲READING 4. PROFESSIONALISM IN THE INVESTMENT INDUSTRY删除

READING 5. ASSET MANAGER CODE OF PROFESSIONALCONDUCT对应新考纲的READING 34

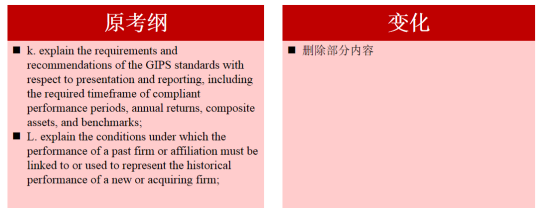

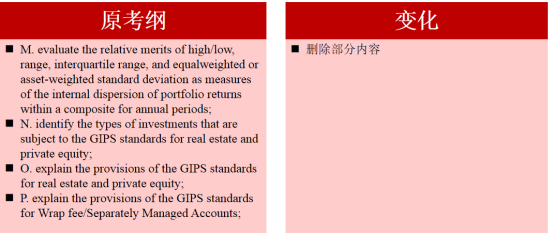

原考纲READING 6. OVERVIEW OF THE GLOBAL INVESTMENT PERFORMANCE STANDARDS 中的

a . discuss the objectives, key characteristics, and scope of the GIPS standards and their benefits to prospective clients and investment managers;更改为discuss the objectives and scope of the GIPS standards and their benefits to prospective clients and investors, as well as investment managers;

b. explain the requirements and recommendations of the GIPS standards with respect to input data, including accounting policies related to valuation and performance measurement;删除

c. d. discuss the requirements of the GIPS standards with respect to return calculation methodologies, including the treatment of external cash flows, cash and cash equivalents, and expenses and fees;

d. 更改为:explain requirements of the GIPS standards with respect to composite return calculations, including methods for asset weighting portfolio returns;

i. explain the requirements of the GIPS standards for asset class segments carved out of multi-class portfolios;

更改为 h. explain requirements of the GIPS standards with respect to presentation and reporting;

以下内容删除:

J. explain the requirements and recommendations of the GIPS standards with respect to disclosure, including fees, the use of leverage and derivatives, conformity with laws and regulations that conflict with the GIPS standards, and noncompliant performance periods;

R. determine whether advertisements comply with the GIPS Advertising Guidelines;

T. discuss challenges related to the calculation of after-tax returns;

U. identify and explain errors and omissions in given performance presentations and recommend changes that would bring them into compliance with GIPS standards.均已删除

好了,今天的文章已经分先给你了,有需要CFA考纲的可以在线咨询我们老师免费获取哦!