CFA一级衍生品在2021年CFA考试中占比是5%-8%,备考冲刺阶段做的更多的是考题,那你这一科目的考题做的怎么样呢?小斌给你说说!

For the price of a futures contract to be greater than the price of an otherwise equivalent forward contract, interest rates must be:

A uncorrelated with futures prices.

B positively correlated with futures prices.

C negatively correlated with futures prices.

CFA备考怎么能少了CFA备考资料呢?小编为各位考生准备了CFA备考资料,有需要可以点击下方链接获取!

这道考题你能不能看懂呢?毕竟是全英文的,其中的核心词汇

是Contract price:合约价格,你知道这是什么意思呢?小编给你说是指在远期或期货合约中标明的交易价格。

在CFA考试中是有很多的词汇要了解的,要知道的,这边有CFA词汇书籍有需要可以在线咨询我们老师!

小编给你说这道考题的答案一级解析,看看你是不是这样理解呢?

B If interest rates are positively correlated with futures prices, interest earned on cash from daily settlement gains on futures contracts will be greater than the opportunity cost of interest on daily settlement losses, and a futures contract will be have a higher price than an otherwise equivalent forward contract that does not feature daily settlement.

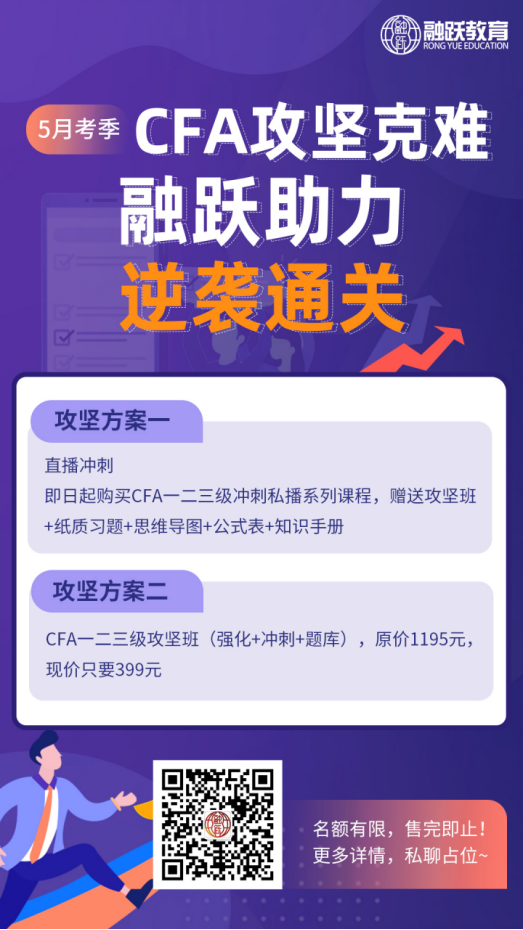

备考2021年CFA考试,你是否已经做好了准备了呢?这边有CFA备考课程,CFA攻坚班包含强化班+冲刺班+智能题库,原价1195元,

强化班:突出重点,化繁为简,配套习题讲解强化解题技巧,强化对重要知识的把握

冲刺班:精选足量真题练习,覆盖必考知识点,考前快速提分一次*

智能题库:仿真CFA机考系统,帮助考生更好的熟练做题

有效期30天,如果你有需要CFA攻坚班的话,限时只需399元

有需要的可以在线咨询或者扫一扫了解详情!