ACCA TX题目分享PART F Value added tax

Required

(a)Calculate the amount by which Zhi can claim to reduce his self-assessment income tax and NICs due for payment on 31 January 2023 without incurring interest or penalties.

(2 marks)

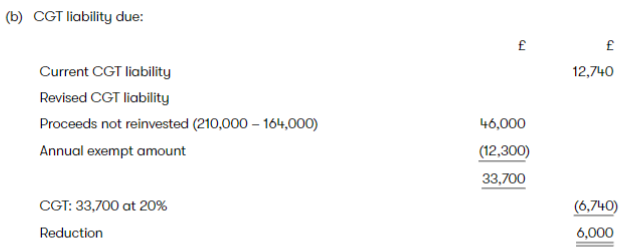

(b)Calculate the amount by which Zhi's CGT liability due for payment on 31 January 2023 will be reduced if he makes a claim for rollover relief based on the warehouse purchased on 1 December 2022 forf164,000.

(3 marks)

(c) Explain whether Zhi can reduce the amount of VAT payable on 7 February 2023 by not issuing a sales invoice for the credit sale of f45,600 until 1 February 2023, and, if so, by how much the payment will be reduced.

(2 marks)

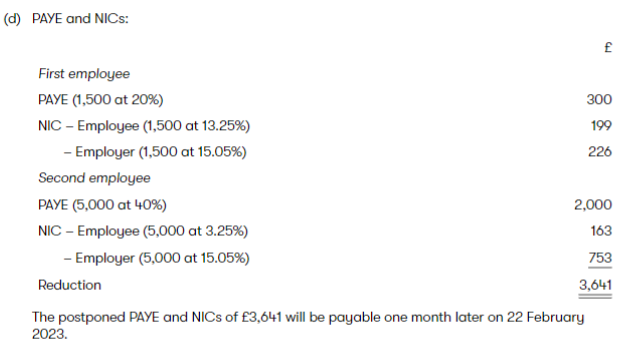

(d)Calculate the amount by which Zhi's PAYE and NICs due on 22 January 2023 will be reduced if he delays the payment of employee bonuses until 10 January 2023, and state when the postponed amount will be payable.

Note. Your calculations should be based on annual income tax and NIC thresholds.

(3 marks)

(Total =10 marks)

(a) The balancing payment for 2021/22 due on 31 Jonuary 2023 cannot be reduced.

A claim can be made to reduce the payment on account for 2021/22 due on 31 January 2023 by £5,040:

Tutorlal note. Equivaient marks will be awarded if the reduction is alternatively calculated as 30,000(76,000-(210,000-164,000)) at 20%=£6,000.

(c)The basic tax point for goods is the date when they are made available to the customer, which in the case of Zhi's sale is 12 December 2022.An involce date of 1 February 2023 will not affect this because the invoice will not have been lssued within 14 days of the basic tax point.

Zhi therefore cannot reduce the amount of VAT payable on 7 Februory 2023.