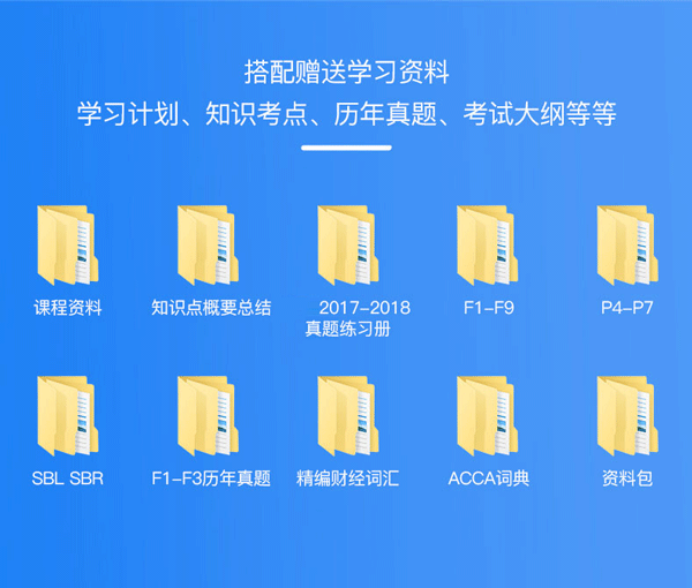

备考ACCA考试学员需要整理的考试资料有很多,通过课程的学习,帮助学员扎实的掌握ACCA考试的重难点。ACCA历年真题练习是每位学员都需要做的,是对ACCA知识点的运用与了解。

戳:“各科必背定义+历年真题中文解析+20年习题册(PDF版)”

1. [单选题]Hindberg is a car retailer. On 1 April 2014, Hindberg sold a car to Latterly on the following terms:

A. Latterly paid $12,650 (half of the cost) on 1 April 2014 and would pay the remaining $12,650 on 31 March 2016 (two years after the sale). Hindberg’s cost of capital is 10% per annum.

B. What is the total amount which Hindberg should credit to profit or loss in respect of this transaction in the year ended 31 March 2015?

C. $23,105

D. $23,000

E. $20,909

F. $24,150

2. [单选题]10 What would the company’s profit become after the correction of the above errors?

A. $634,760

B. $624,760

C. $624,440

D. $625,240

3. [单选题]The following information is available for a manufacturing company which produces multiple products:

A. (i) The product mix ratio

B. (ii) Contribution to sales ratio for each product

C. (iii) General fixed costs

D. (iv) Method of apportioning general fixed costs

E. Which of the above are required in order to calculate the break-even sales revenue for the company?

F. All of the above

G. (i), (ii) and (iii) only

H. (i), (iii) and (iv) only

I. (ii) and (iii) only

1、正确答案 :F

解析:At 31 March 2015, the deferred consideration of $12,650 would need to be discounted by 10% for one year to $11,500 (effectively deferring a finance cost of $1,150). The total amount credited to profit or loss would be $24,150 (12,650 + 11,500).

2、正确答案 :D

解析:630,000 – 4,320 – 440

3、正确答案 :G

解析:The method of apportioning general fixed costs is not required to calculate the break-even sales revenue.

以上就是融跃教育小编对ACCA考试内容的分析!ACCA知识点的学习是帮助学员更好掌握ACCA的基本知识点,如果学员还有更多想要学习的内容,可以者添加融跃教育老师微信(rongyuejiaoyu)。