对于每一位ACCA学员来说,要想有好的考试成绩,必然需要有足够的时间去备考才可以。ACCA考试备考不仅是知识点的学习,同时也需要进行考试重难点的学习,帮助学员更好的掌握ACCA考试的知识点内容。

ACCA证书是财会人必考的证书,ACCA真题是考试离不开的练习!

戳:“各科必背定义+历年真题中文解析+20年习题册(PDF版)”

1. [单选题]19 At 30 June 2004 a company’s allowance for receivables was $39,000. At 30 June 2005 trade receivables totalled $517,000. It was decided to write off debts totalling $37,000 and to adjust the allowance for receivables to the equivalent of 5 per cent of the trade receivables based on past events.

What figure should appear in the income statement for these items?

A. $61,000

B. $22,000

C. $24,000

D. $23,850

2. [单选题]Is the following statement true or false?

B. True

C. False

3. [单选题]Mr Li, a photographer, had his photos published in the July 2014 edition of the tourism journal. The total fee was RMB20,000 and the publisher agreed to pay Mr Li by two instalments, one of RMB18,000 in June 2014 and the balance of RMB2,000 in August 2014. The same photos were republished by the government in a promotion brochure in August 2014 and Mr Li was paid a further fee of RMB3,000 by the government.

A. What is the total amount of individual income tax (IIT) which Mr Li will pay on the above incomes?

B. RMB2,492

C. RMB2,576

D. RMB2,548

E. RMB3,680

1、正确答案 :B

2、正确答案 :B

解析:Where there is a significant change in ownership of the company, ISA 210 Agreeing the Terms of Audit Engagements recommends that a new audit engagement letter is sent to avoid misunderstandings.

3、正确答案 :D

解析:20,000 x (1 – 20%) x 20% x 70% + (3,000 – 800) x 20% x 70% = RMB2,548

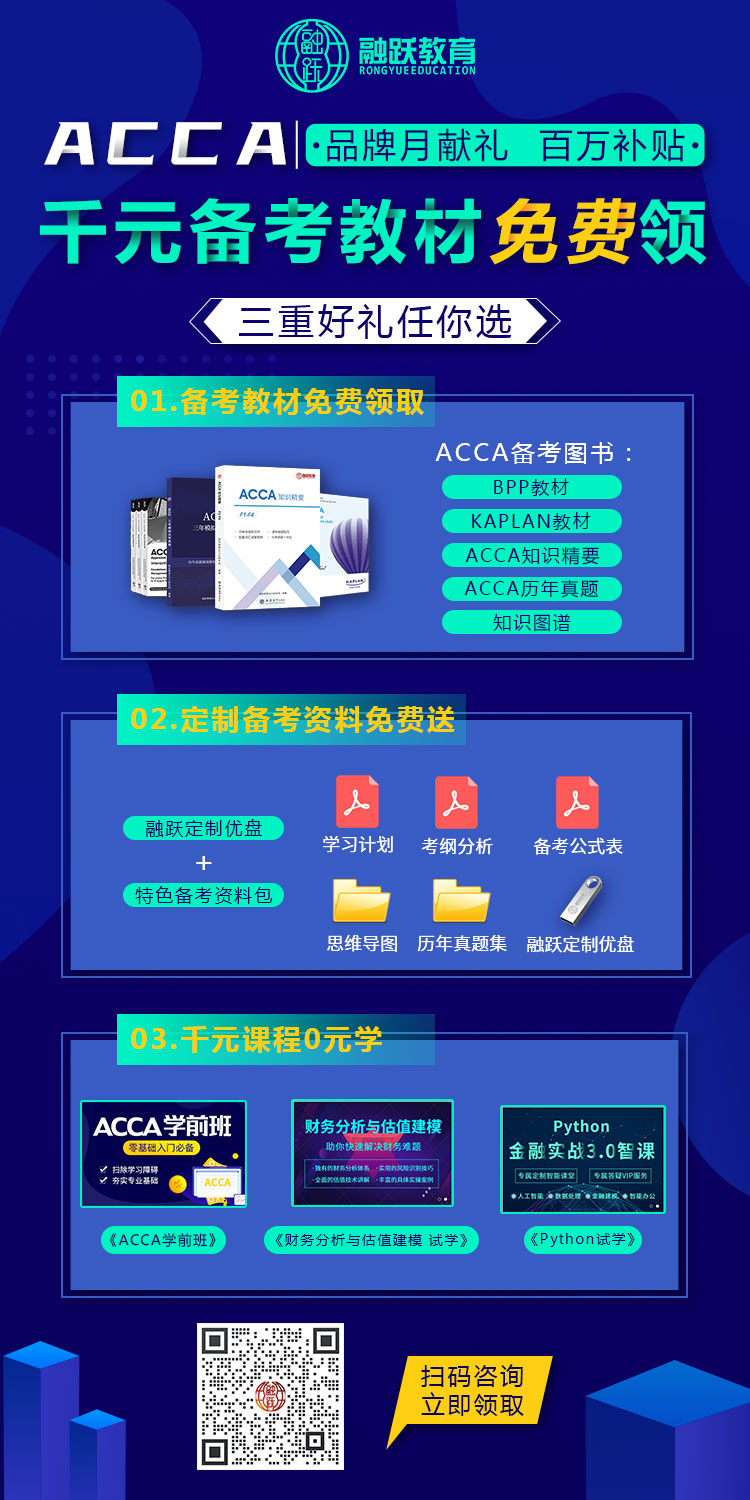

备考ACCA考试中你是不是无从下手,也不知道该怎么备考,这不,这边为你准备了ACCA备考攻略和资料,有需要的在线咨询或者添加老师微信:rongyuejiaoyu

阅读排行

- 1 ACCA证书申请条件有哪些?ACCA证书申请流程

- 2 ACCA考生参加分季机考的注意事项

- 3 ACCA考试哪些城市有考点?

- 4 ACCA 2025全国大学生财智精英挑战赛报名仅剩12天!

- 5 上海市境外职业资格证书认可清单发布,涉及ACCA、CFA、CMA人才政策

- 6 《上海市境外职业资格证书认可清单(3.0版)》正式发布,FCCA及ACCA证书连续第三年入选!

- 7 3万元奖励!ACCA人才获郑州航空港经济综合实验区政策支持

- 8 ACCA伦敦大学专业会计学士学位(BSc)2026年3月入学批次现已开放申请

- 9 ACCA考试需要多少钱?ACCA考试难度大不大?

- 10 持有ACCA证书职业发展?