普通股融资方法有几种?在备考CFA考试中你这个知识点是不是掌握了呢?是不是掌握了这些知识吗?如果你学习了这个知识点,看看你是不是掌握了这个知识呢?看看小编给你准备的考试题!

Faye Harlan, CFA, is estimating the cost of common equity for Cyrene Corporation.

She prepares the following data for Cyrene:

·Price per share = $50.

·Expected dividend per share = $3. ·Expected retention ratio = 30%.

·Expected return>·Beta = 0.89.

·Yield to maturity>·The expected market rate of return is 12% and the risk-free rate is 3%.

Based on these data, Harlan determines that Cyrene's cost of common equity is 14%. Harlan most likely arrived at this estimate by using the:

A. dividend discount model approach.

B. capital asset pricing model approach.

C. bond yield plus risk premium approach.

【答案】C

【解析】运用CAPM:estimated cost of common equity = 3% + 0.89(12% - 3%) = 11%.

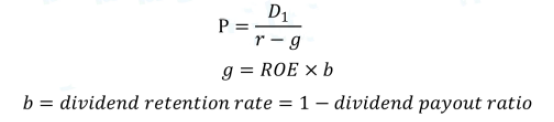

运用DDM:growth rate = (0.3)(0.2)=6%,estimated cost of common equity = $3 / $50 + 6% = 12%.

因此如果计算出的股权融资成本为14%, Harlan运用的方法应该是bond yield + risk premium。

(1)三种计算方法

方法一: CAPM (Capital Asset Pricing Model)

Ri= Rf +βi [Rm-Rf]

方法二:DDM(Divident Discount Model)

方法三:bond yield +risk premium (注意bond yield 是债券的YTM,是before taxt cost of debt)

CFA知识点的学习是帮助学员更好掌握CFA的基本知识点,如果学员还有更多想要学习的内容,可以在线咨询老师。