ACCA TX题目分享Value added tax,Corporation tax liabilities

发表时间:2025-05-29

ACCA TX题目分享Value added tax,Corporation tax liabilities

第一道题:PART F Value added tax(X)

For the quarter ended 31 March 2023, what is the amount of non-deductible input VAT in respect of entertaining UK customers and the leasing cost of the car?

第一道题:PART E Corporation tax liabilities(X)

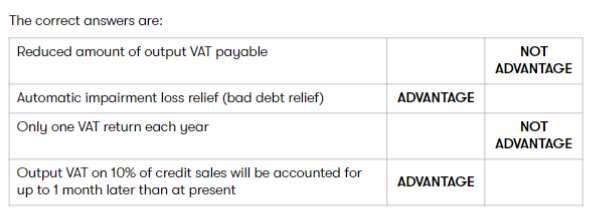

ldentify, by clicking on the relevant boxes in the table below, whether each of the following statements are the advantages of Anne using the cash accounting scheme.

解析:

B Option 2

The output VAT payable will remain the same and accounting for VAT will also remain the same.

C Option 3

D Option 4

答案:C

The correct answer is: Option 3

The input tax of £800×20%=£160 on entertaining UK customers is non-deductible (but would be deductible for entertaining overseas customers). The answer £0 permits deductionof input tax on entertaining UK customers.

50% of the input tax is deductible on leased cars where there is some private use so the remaining 50%×£700×20%=£70 is non-deductible. The answer £105 is 75%×£700×20%=£105(ie based on the amount of private use).

A Option 1

相关精选解答 更多>

-

ACCA考试F阶段备考重点!

不管是备考ACCA考试的哪个阶段,都要知道每个阶段的备考重点,小编给大家整理了一下ACCA考试F阶段的备考重点,下面来跟着小编一起来了解一下吧!

2025-12-18 14:36:1264人已阅读 -

ACCA考试F阶段备考规划!

ACCA考试因为科目比较多,所以考试的时候分为不同阶段来进行报考,下面小编和大家说的是ACCA考试F阶段的备考规划,下面来和小编一起来详细了解一下吧!

2025-12-10 15:24:41237人已阅读 -

FA学霸笔记-Chapter 5-3

根据试算平衡表的金额编制报表,先编制利润表,再编辑资产负债表(假设没有期末调账后续章节讲解期末调账)

2025-10-09 15:02:591154人已阅读