FRM市场风险测量与管理题目分享Gauss Model

发表时间:2025-05-06

FRM市场风险测量与管理题目分享

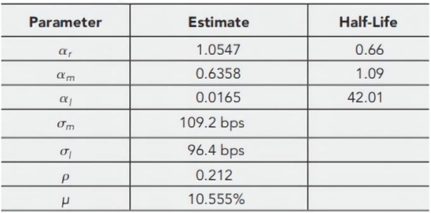

According to the figure below, which of the following statements is least likely to be true about estimated Parameters of the Gauss+ Model from US Treasury Zero Coupon Yields, January 2014 to January 2022.Half-Life Is in Years?

A The mean reversion parameters are in the order expected, with the central bank reaction fastest, the speed of the medium-term factor's reversion to the long-term factor next, and the speed of the long-term factor's reversion to p slowest.

B the time for each process to converge halfway to its target, given in the half-life column, is about eight months for r, 13 months for m, and 42 years for I.

C the volatility parameters of 109 and 96 basis points for the medium- and long-term factors, respectively,

D None of the above is true

解析:

D

All of the above are true

相关精选解答 更多>

-

FRM一级考试备考!

很多朋友在报名FRM考试之后,开始备考的时候不知道要怎么做了,这样的情况其实并不是很少见,所以为了让大家更快的进入到备考的节奏中,小编给大家整理了一份FRM一级考试备考攻略,希望可以在备考的过程中帮助到大家。

2025-12-17 15:07:40277人已阅读 -

FRM二级考试备考!

想要拿到FRM证书,对于FRM的每一个等级考试备考都要认真对待,小编下面就来和大家说一下FRM二级考试备考要如何去做。下面来跟着小编一起来看一下吧!

2025-12-09 14:43:32608人已阅读 -

FRM考试备考学习方法!

很多朋友在看到FRM考试需要用英文考试的时候会有一种退缩的想法,但是其实备考FRM考试也是有学习方法的,下面小编就来和大家介绍一些在学习FRM的时候可以用到的学习方法。

2025-12-02 15:42:38901人已阅读