jason 2020-09-22 08:42

致精进的你:

同学,SAR一律按单尾哈

The real talent is resolute aspirations.

真正的才智是刚毅的志向。

追问12020-09-22 12:06

请问一下这道题正确解题思路是什么呢?麻烦老师写出来一下

回答2020-09-22 13:55

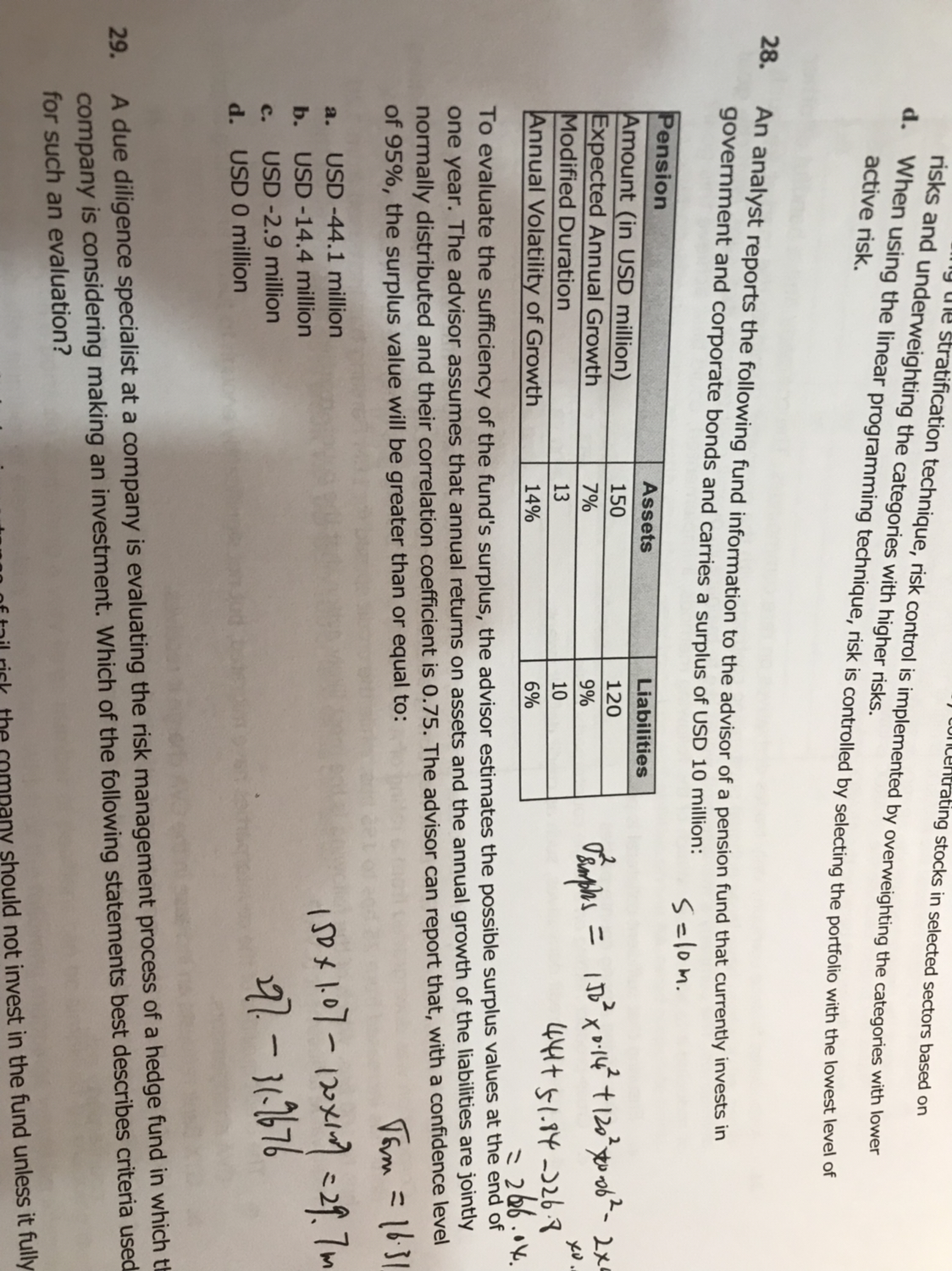

he lower bound of the 95% confidence interval is equal to: Expected Surplus – (95% confidence factor×Volatility of Surplus). The required variables can be calculated as follows. Let RA and RL be the annual returns on assets and the annual growth of the liabilities, respectively. Also, let VA and VL be the original amount of assets and liabilities, respectively. Let S be the surplus. Thus, S= VA × (1+RA) - VL × (1+RL). variance of surplus=150^2*14%^2+120^2*6%^2-2*150*120*14%*6%*0.75=266.04 Volatility of surplus =266.04^0.5=16.31 Expected surplus=150*(1+7%)-120*(1+9%)=29.7 29.7-1.645*16.31=2.87