Ben 2020-07-20 10:19

致精进的你:

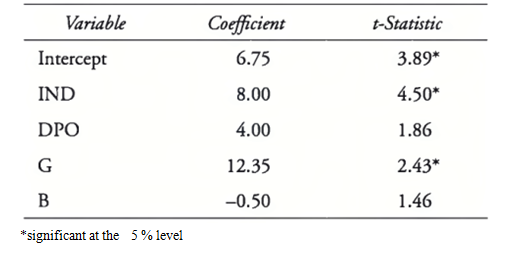

同学你好,这道题原本是这样子的,我这边看了下后台题目是完整的,不知道为什么你那边显示不全。 Phil Ohlmer estimates a cross sectional regression in order to predict price to earnings ratios (P/E) with fundamental variables that are related to P/E, including dividend payout ratio (DPO), growth rate (G), and beta (B). In addition, all 50 stocks in the sample come from two industries, electric utilities or biotechnology. He defines the following dummy variable: IND = 0 if the stock is in the electric utilities industry, or = 1 if the stock is in the biotechnology industry The results of his regression are shown in the following table. 此处表格见图片 Ohlmer is valuing a biotechnology stock with a dividend payout ratio of 0.00, a beta of 1.50, and an expected earnings growth rate of 0.14. The predicted P/E on the basis of the values of the explanatory variables for the company is closest to:

The real talent is resolute aspirations.

真正的才智是刚毅的志向。