来自:FRM > 二级 > Operational and Integrated Risk Management 2020-10-29 17:52

183****7313

提问

23

上次登录

442天前

183****7313

提问

23

上次登录

442天前

jason 2020-10-30 09:15

致精进的你:

同学,CVA - credit valuation adjustment,又叫counterparty credit charge. 是用来量化评估over the counter 衍生品违约风险的一个量,反映的是衍生品交易一方对另一方违约风险及由此导致的损失量度的估计。具体内容可以去回顾一下信用风险CVA的基础课程

The real talent is resolute aspirations.

真正的才智是刚毅的志向。

追问12020-10-30 13:13

那BA-CVA的计算方法,跟信用风险里面讲的CVA计算一样吗?还是巴三优化了这个计算方式?

回答2020-11-02 14:13

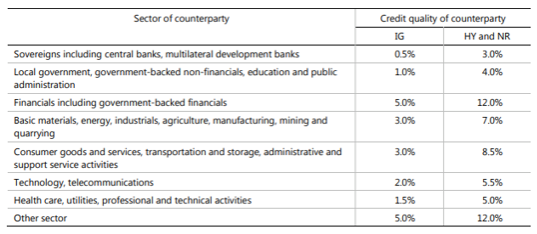

同学,Basic Approach to CVA:The Standalone CVA Capital is designated as SCVA. It is governed by the Risk Weight for the counterparty – this risk should, in theory, reflect the volatility of its’ credit spread. These risk weights are shown below:如图所示